straight life policy definition

Paid Until Age 65. With term insurance a death benefit is a primary feature.

Pin By Kelsy Jones On Good Eats Health Facts Workout Food Health Info

Straight Life Policy an ordinary life policy or whole life policy.

. This traditional life insurance is sometimes also known as whole life insurance or cash value insurance. See How Term Life Can Help Protect Your Familys Future. But whole life policies combine both a death benefit and a savings feature.

A straight life insurance policy is a type of permanent insurance that provides a guaranteed death benefit and has fixed premiums. This traditional life insurance is sometimes also known as whole life insurance or cash value insurance. With a straight life policy a portion of your premium pays for the insurance and the rest accumulates tax deferred in a cash value.

A straight life insurance policy is a type of permanent insurance that provides a guaranteed death benefit and has fixed premiums. For example a 500k 10 year limited pay whole life insurance policy will cost more than a 500k 20 year policy. Lets start by looking at the different payment terms.

Because the payouts will be shorter in duration they offer the highest periodic payments. A 20-payment whole life insurance policy is a type of limited payment whole life insurance where premiums are paid over a shorter period of time according to the New York State Department of Financial Services. Straight life policies offer higher payouts than plans that include a death benefit component making them a great choice for investors who want to maximize their retirement.

STRAIGHT LIFE INSURANCE used as a. Easy Online Application with No Medical Exam Required Just Health and Other Information. Upon expiration the policyholder may decide to renew the policy or allow it to lapse.

A straight life annuity is an annuity that pays a guaranteed stream of income but ceases payments upon the death of the annuity holder. As a general rule of thumb fewer years results in a higher annual premium. A life insurance policy that provides coverage only for a certain period of time.

With a straight life policy a portion of your premium pays for the insurance and the rest accumulates tax deferred in a cash value. Insurance on the life of the insured for a fixed amount at a definite premium that is paid each year in the same amount during the entire lifetime of the insured. As a life insurance policy it represents a contract between the insured and insurer that as long as the contract terms are.

The noun STRAIGHT LIFE INSURANCE has 1 sense. The most common options include. A straight life insurance policy is a form of permanent life insurance with set premiums that provides a guaranteed death benefit.

What does the word straight indicate when using this phrase The most important factor to consider when determine whether to convert term insurance at the insureds attained age or the i sureds original age is Q would like to purchase. Study with Quizlet and memorize flashcards containing terms like Whole life insurance is sometimes referred to as Straight Life. Ad Exclusive AARP Member Benefit.

An advantage in getting term insurance is its often less expensive because it doesnt include the additional benefit of having a savings account. Straight life annuities do not include a death benefit so payments cant be made to a beneficiary. How do Annuities Work Nationwide.

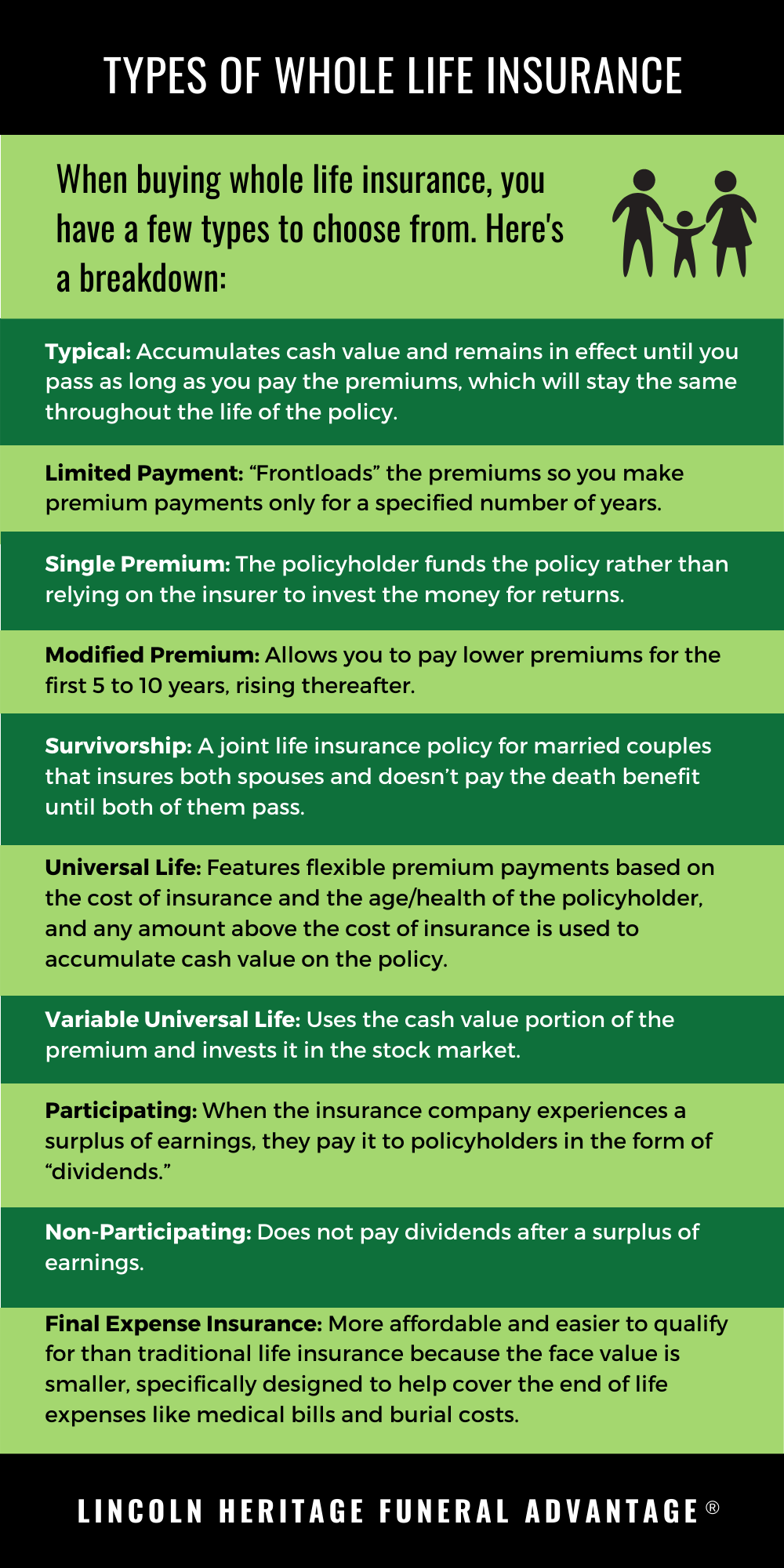

Decreasing term insurance is a type of annual renewable term life insurance that provides a death benefit that decreases at a predetermined rate over the life of the policy. Whole life insurance is permanent life insurance that pays a benefit upon the death of the insured and is characterized by level premiums and a. Whole life insurance or whole of life assurance sometimes called straight life or ordinary life is a life insurance policy which is guaranteed to remain in force for the insureds entire lifetime provided required premiums are paid or to the maturity date.

Straight-life whole life insurance insured pays premiums for by life At different death cut the insured the beneficiary receives the pass value of her policy. Under this plan a person. Straight life policies are designed to provide a steady stream of income to annuitants through periodic payments which are only discontinued when the annuitant dies.

The downside is that at the end of the term the policy will. Whole life insurance is a type of life insurance that provides coverage for the entirety of the policyholders life and has a savings component. It pays out a death benefit upon the policyholders death and it accumulates cash value over time that the policyholder may withdraw for personal use or borrow against.

A straight term insurance policy provides a benefit upon the death of the policyholder but ceases to provide this benefit if heshe is still alive when the policy expires. The policys duration is your entire lifetime which is different from term life insurance which ends after a specified number of years. Premiums are usually.

Life Happens Baking Helps Shirt New Design In 2022 Cool Shirts Shirts Trending Shirts

Pin On There S A Joke Here Somewhere

/GettyImages-1134608493-a72c93c4adc34ee3b5a1c6e54dffa379.jpg)

Whole Life Insurance Definition

Straight Life Annuity Definition

Review Of Straightalk Pay As You Go Phone Service

Picture Photo Frame Family Definition Quote 20oz Skinny Tumbler Sublimation Designs Tumbler For Straight Tapered Png File Digital Download

What Is Whole Life Insurance And How Does It Work Lincoln Heritage

I May Be Straight But I Don T Hate Lgbt Shirt

:max_bytes(150000):strip_icc()/best-whole-life-insurance-4845955_final-c60b6733837046e5a5213deb9e87ccd5.png)

Best Whole Life Insurance Companies Of 2022

Discover Cool Im Making A Human What Have You Done Today Maternity Shirt In 2022 Funny Tshirts Shirts For Teens Funny Shirts

How To Easily Calculate Straight Line Depreciation In Excel Exceldatapro Straight Lines Excel Line

Pin By Pinner On Stay Home Stay Safe Home Quotes And Sayings Definition Quotes Quotes Inspirational Positive

Trailer Park Boys Straight Outta Sunnyvale Bubbles Long Sleeve In 2022 Trailer Park Boys Sunnyvale Trailer Park

:max_bytes(150000):strip_icc()/straight-line-depreciation-method-357598-Final-5c890976c9e77c00010c22d2.png)